Epic Poker League, Heartland Poker Tour Acquired by Pinnacle Entertainment

The Heartland Poker Tour and assets of Federated Sports + Gaming Inc. were acquired by Pinnacle Entertainment, Inc. at a bankruptcy auction this week.

According to reports, Pinnacle was one of at least four groups bidding on the HPT and FS+G in the United States Bankruptcy Court for the District of Maryland on Wednesday and Thursday. The highest bid for the HTP went for $4.2 million, and FS+G's assets went for $300,000. Those assets include the Epic Poker League, Global Poker Index, and the EpicPoker.com website.

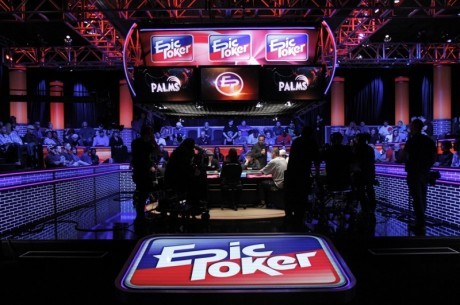

Federated Sports+Gaming was formed in January 2011 by Jeffrey Pollack, Annie Duke, and a handful of others. In June 2011, the organization created the Epic Poker League, promising a PGA-style league that was "for the players" with tournament overlays and a $1 million freeroll. The league was postponed during the first season for what organizers initially called a "scheduling conflict." FS+G filed for Chapter 11 bankruptcy two months later.

In April, FS+G reported nearly $7.9 million in liabilities and had only $38,000 in cash on hand according to bankruptcy filings. Pinnacle was owed an estimated $2.1 million in regard to a loan made to FS+G earlier this year to purchase the HPT from All In Productions. AIP is still owed approximately $2 million from the sale, and about 100 other creditors are owed close to $3.7 million by FS+G.

According to the court document released on Thursday, a group of creditors are arguing that the HPT knew about FS+G's insolvency when it was sold by All In Productions. As such, the committee believes that the $1 million payment to AIP in January should be treated as a fraudulent transfer.

Paragraph 11 of the document reads as follows:

The Committee has reviewed the filings in these cases and the confidential documents produced by the Debtors that evidence, relate or refer to (i) the prepetition purchase of the Heartland Tour assets and payments to AIP and its principals, and (ii) the Debtors�� financial condition at the time of the transaction and thereafter. Based on this review, the Committee believes that the APA rendered FSG insolvent, that FSG did not receive reasonably equivalent value in exchange for the AIP Transfers, and that the AIP Transfers are avoidable as fraudulent transfers under Section 548 of the Bankruptcy Code. In just a matter of five months after the closing of the APA, the Debtors were in default of their obligations to AIP, and it is apparent that the Debtors did not have sufficient capital to continue in business and meet their obligations in the ordinary course as a result of the APA and the transfers made thereunder.

PokerNews will have more in this story as additional information becomes available.

Stay up to date on all the latest news by following us on Twitter and liking us on Facebook.